Table of Contents

ToggleIntroduction

On July 31, 2023, National Deep Tech Startup Policy Consortium (“NDTSP Consortium”) chaired by the Principal Scientific Adviser to the Government of India, issued the Draft National Deep Tech Startup Policy (the “Draft Policy”) for public consultation. The Prime Minister’s Science, Technology, and Innovation Advisory Council, in its 21st meeting held on July 7, 2022, recommended the creation of the NDTSP Consortium and a working group to propose a comprehensive policy framework to address the needs and strengthen the Indian deep tech start-up ecosystem.

Objectives

The Draft Policy complements and adds value to the existing Startup India policies, programmes and initiatives, by providing effective policy measures to strengthen the ecosystems of deep tech start-ups. The Draft Policy aims to drive innovation, economic growth, and societal development with following key objectives (among several others):

- Strengthen the research and innovation ecosystem leading to scientific breakthroughs

- Bolster the Indian intellectual property regime

- Facilitate access to diverse sources of capital

- Enable infrastructure and resource sharing

- Foster a culture of cutting-edge research in academia that is industry relevant

- Attract and retain the finest human capital

- Create a conducive regulatory environment for innovation by introducing exemptions and incentives

- Promote public and private adoption of indigenous deep technologies

Defining "Deep Tech Startup"

The Draft Policy recognizes the need to define a “deep tech startup” and recommends indicative parameters to ascertain what qualifies as a “deep tech startup”. A deep tech start-up is one which (a) involves early-stage technologies which have yet to be commercialized; (b) produces a solution along an unexplored pathway based on a new knowledge within a scientific and/or engineering discipline; (c) can leverage (a) and (b) above to create and own intellectual property; (d) has high technical and scientific uncertainty tagged with high risk or opportunity; and (e) is characterized by extended development timelines and requires high capital intensity. The ‘depth’ in deep tech startups is contextual and dependent on the maturity of scientific and technological pursuit.

The Draft Policy expands on the criteria to differentiate between hardware (for instance: 3D printing, Semiconductor, Robotics, Nanotechnology) and service (for instance: Artificial Intelligence, Security Solutions, Cloud, Enterprise Mobility, Analytics) deep tech start-ups:

- Hardware deep tech startups: solutions requiring Research and Development (“R&D”) of more than 3 years and INR 10 crores (in non-R&D capital expenditure) before commercialization.

- Service deep tech startups: solutions requiring R&D more than 1 year and INR 1 crore (in non-R&D capital expenditure) before commercialization.

The common parameter underlying both hardware and service deep tech is the inherent potential to impact the economy with an economic rate of return of more than 30%.

Priority Areas

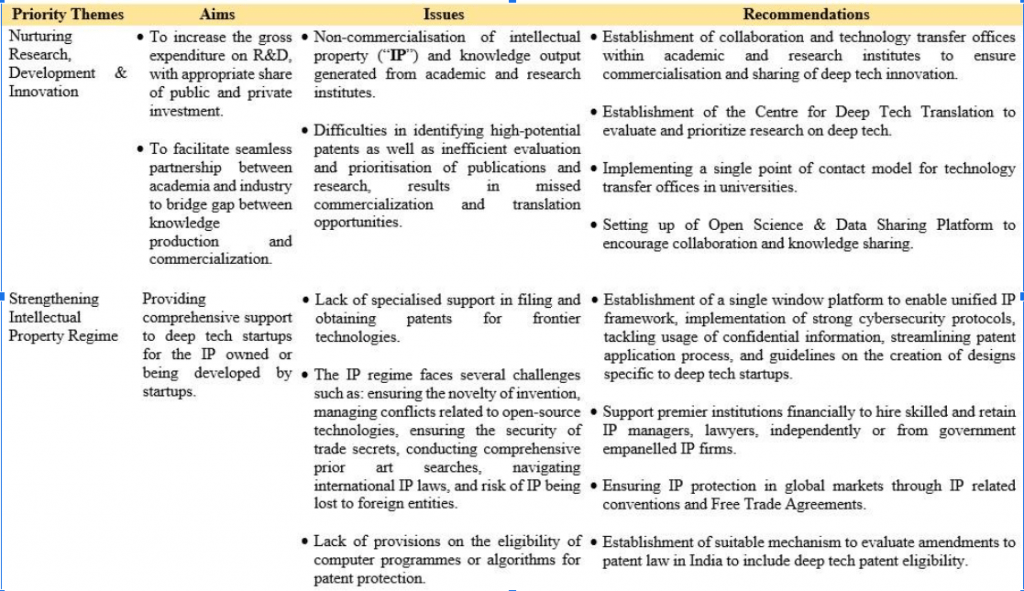

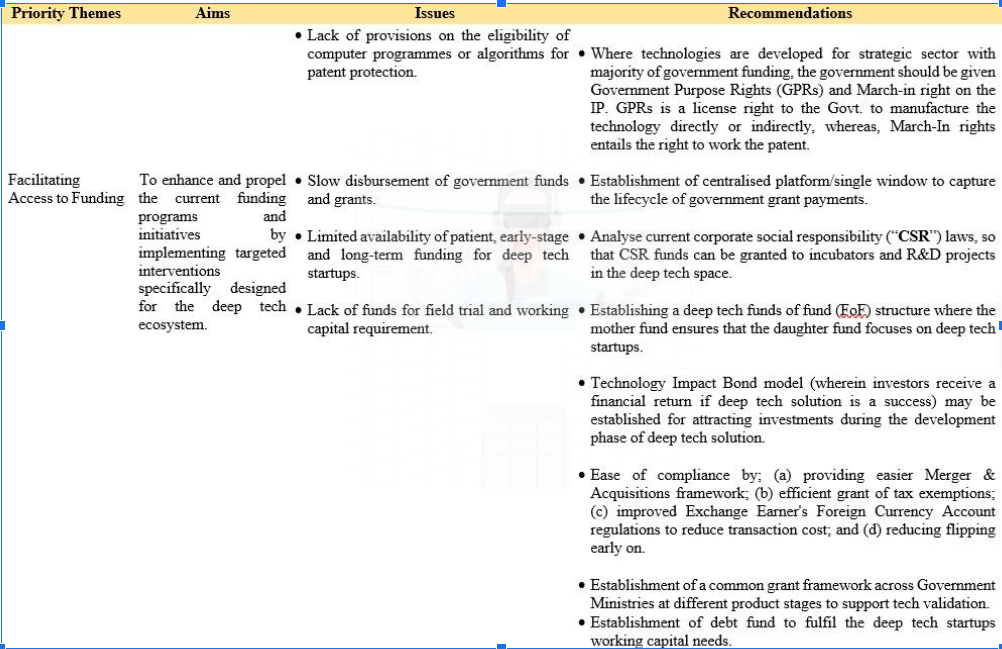

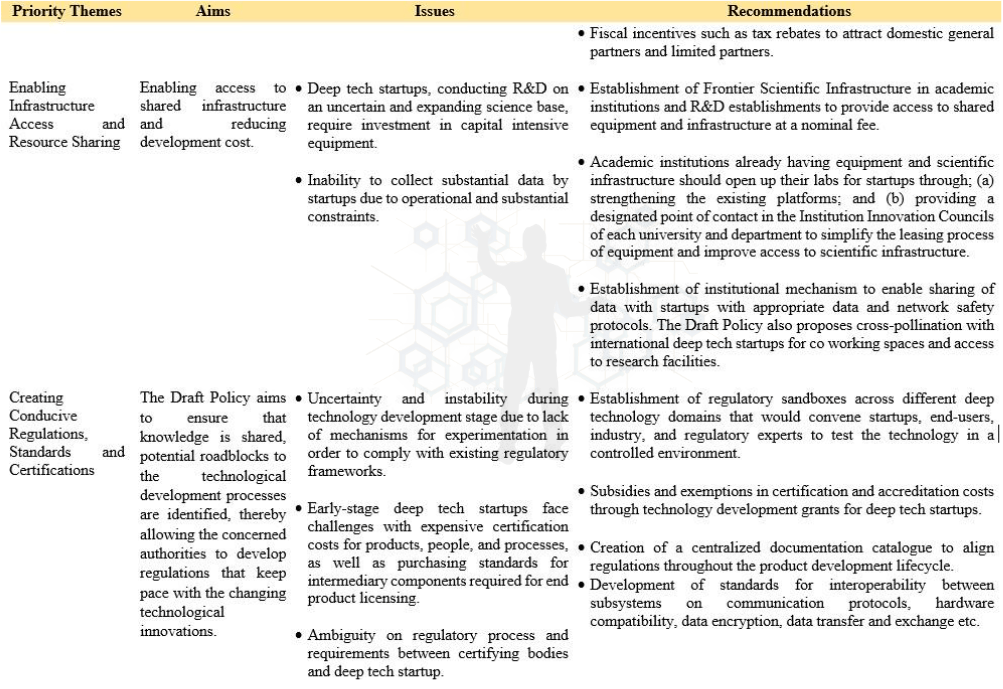

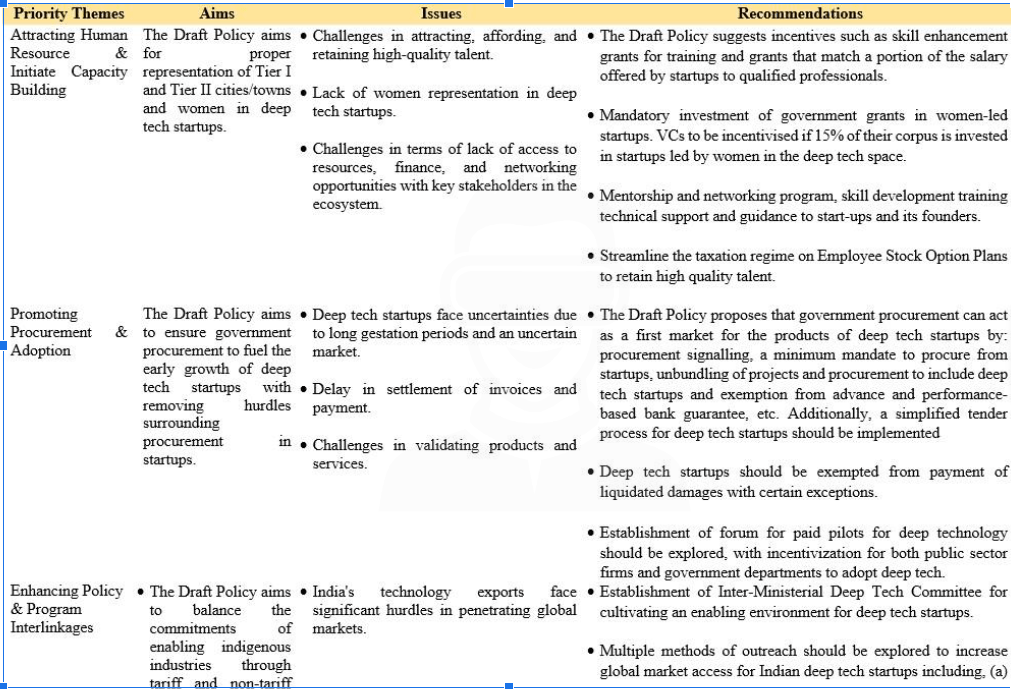

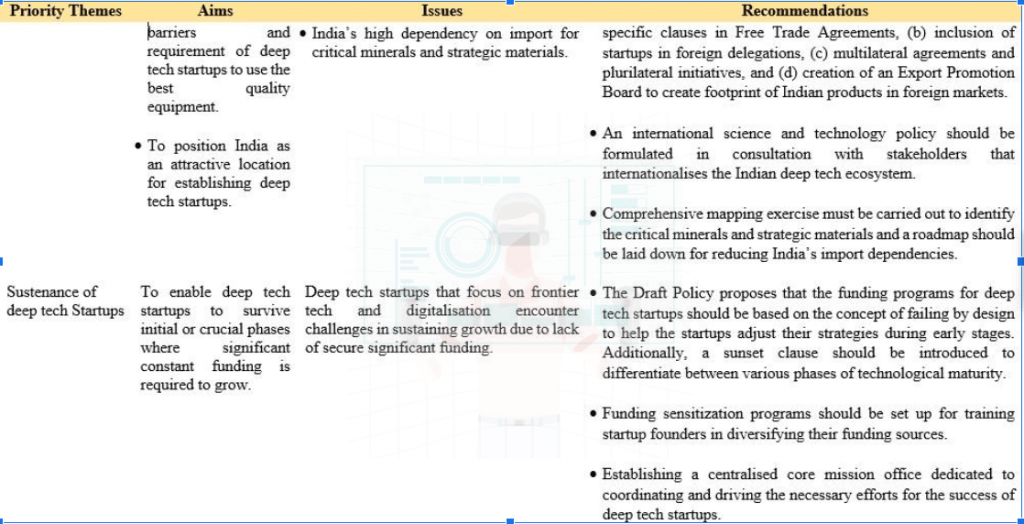

The Draft Policy identifies the following 9 priority themes and suggests necessary policy changes to foster the development of a favourable environment for deep tech start-ups:

Way Forward

The Draft Policy demonstrates a positive first step towards creating a robust Indian deep tech startup ecosystem which India currently lacks. The Draft Policy has rightfully tried to identify and define deep tech startups to enable stakeholders in identifying and supporting deep tech startups more effectively. Additionally, the intention to ease and streamline the compliance burden and introducing regulatory sandbox reflects a forward looking approach that can foster growth and innovation in this sector. The Draft Policy further recognizes that the funding requirements of a deep tech startup differs that from a typical startup, and thus has proposed setting up of specialized funds for various stages, goals and needs of deep tech startup such as a debt fund for working capital and test pilot funds for testing protypes. Additionally, it also recommends that the tenure of funds should be longer for specialized funds investing in deep tech startups in order to align with the extended gestation period of deep tech startups.

While the Draft Policy recognizes importance of ESOPs in building the ecosystem, it still falls short on providing sufficient guidance on tax and regulatory issues it aims to resolve with regard to ESOPs. Furthermore, the Draft Policy also overlooks a significant aspect; the importance that advisory shares play in attracting skilled talent. Considering, that along with ESOPs, advisory shares also plays an important role in attracting and retaining talents with minimum cash outflows, the Draft Policy could have suggested relevant amendments to the Companies Act, 2013 to the extent it allows the issuance of advisory shares with minimum compliance.

While the Draft Policy did focus on improving taxation regime applicable to startups and suggested increasing the tax exemption under Section 80-IAC of Income Tax Act, 1961 from 3 continuous financial years to 5 continuous financial years (which can be availed at the option of the startup within 10 years of the incorporation), however, it overlooked that deep tech startups are rarely profitable in its first 6-7 years, let alone have a revenue generating business. Considering that deep tech startups take years in developing commercially viable technology, the Draft Policy, could have alternatively suggested commencing the period for tax holiday from the date of commercialization of the product, which would directly benefit the deep tech startups.

The Draft Policy also missed in addressing the specific valuation requirements for deep tech startups, given that the funding requirements of a deep tech startups differs due the longer product development cycle. The typical valuation methods such as net asset value and discounting cash flow methods wouldn’t truly be able to assess the valuation of a deep tech startup. Furthermore, addressing valuation concerns for deep tech startups would further support the measures being taken to reducing flipping in Indian deep tech startups. We also see that startups gravitate towards the US or Singapore to tap into markets where product acceptance aligns more favorably with economic considerations. Though the Draft Policy provides for some framework that generates awareness and advocates for adoption of deep tech, however, significant measures, recommendations and initiatives are still required to promote consumer awareness and creating a market in India, which will consequently help retain such deep tech startups within India.

While the Draft Policy discussed at length various recommendations streamlining the IP regime, it missed out on recommending implementation of model contracts for IP transfer. Such model IP transfer contracts would not only be in national security interest, but it would also streamline the IP transfer process. Furthermore, establishing centers for providing contractual support from legal experts who specialize in different sectors of deep tech startups could have been a welcomed recommendation considering the Draft Policy already envisages mentorship by experts. Legal support becomes especially necessary in the funding process for early stage deep tech startups considering that rights of the investors are supposed to be balanced in an investment structure where there may be extended exits. Moreover, robust legal guidance assumes significance as it can offer direction to deep tech startups concerning the legal validity of their innovative products. The Draft Policy stops short of providing a formal mechanism for such assistance, however, it recognizes the importance and need of such a format.

The outlined recommendations undoubtedly hold promise for propelling the deep tech startup ecosystem forward. Nonetheless, translation of these recommendations into tangible progress is contingent upon comprehensive development of these proposals into well-defined laws, regulations, directions and their effective implementation. In the current landscape, where regulations are always playing catch-up with technological advancements, the Draft Policy signals a proactive approach with an aim towards cultivating an environment conducive to the flourishing of deep tech startups.