Table of Contents

ToggleIntroduction

In the evolving landscape of Indian entrepreneurship, the phenomenon of Indian startups ‘flipping’ into foreign jurisdictions has emerged as a strategic maneuver, capturing the attention of founders, investors and industry observers. This trend, marked by the relocation of startup headquarters to international destinations such as US and Singapore, brings forth a myriad of implications which needs to be navigated.

In this article, we delve into the dynamics of this trend, exploring the key factors propelling the flipping phenomenon and its impact on the Indian startup landscape. Moreover, we analyze the recent shifts in India’s regulatory regime, examining how these changes are influencing the decisions of startups to consider foreign shores for their corporate homes.

What is a Flipping / Externalization Phenomenon?

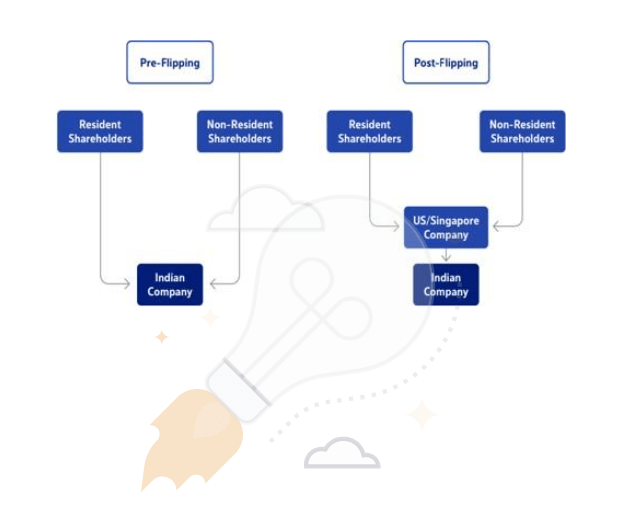

The terms externalization, flipping, or offshoring are used interchangeably to describe the process in which a company initially incorporated in India moves its holding company to a foreign jurisdiction.

In the startup context, it involves transferring the entire ownership of a start-up incorporated in India to an overseas entity, which is owned and controlled by the founders instead. This process essentially turns an Indian startup (company) into a 100% subsidiary of a foreign entity. In such a scenario, the assets, employees and even intellectual property may remain in the Indian subsidiary itself.

Not only younger companies, but several unicorns have also undergone flipping or externalization to foreign jurisdictions such as the US, Singapore, and the United Kingdom.

Effect of Flipping on the company’s structure

Source: Indian Economic Survey 2022-23

Reasons for Externalization/Flipping

Several factors contribute to the decision-making process of a company before flipping. This includes the impact of regulatory regimes and ease of doing business in foreign jurisdictions, the motivation for tax arbitrage driven by India’s relatively high corporate tax rates and the advantageous access to global capital and higher valuations through offshore holding.

While the regulatory and tax concerns often lend significant weightage behind startups flipping, one must keep in mind other important factors as well, such as the jurisdiction in which the startup’s clients are based, its business operations are aimed at and the stage of the market/industry in the country, in which the start-up is operating in.

Much needed relaxation for flip structures under the New Overseas Investment Regime

The flipping structure entails a dual flow between India and a holding company located overseas, creating what is commonly referred to as a ’round-trip structure’. The outbound investment triggers exchange control regulations on Overseas Direct Investment (“ODI”), while the inward flow invokes regulations on Foreign Direct Investment (“FDI”).

Traditionally, foreign entities have had the liberty to invest in India, contingent upon factors such as entry routes, sectoral caps, and pricing guidelines governed by the FDI policy. However, under the previous ODI regime, regulatory uncertainties and ambiguities prevailed. For instance, a crucial consideration for an Indian entity investing in a foreign counterpart was the requirement that the foreign entity engages in a ‘bona fide business activity’. Unfortunately, the old regime lacked clarity on what constituted such an activity, resulting in unnecessary confusion and uncertainty during the approval process from the Reserve Bank of India(“RBI”).

The revised ODI regime has addressed this ambiguity by defining bona fide business activity’ as any business permissible under the laws of both India and the host country. This comprehensive definition encompasses all businesses legal in both jurisdictions, eliminating the previous confusion.

Conclusion

In summary, the ‘flipping’ phenomenon observed in Indian startups, marked by their strategic relocation to foreign jurisdictions, introduces a transformative dynamic with profound implications for the country’s startup ecosystem.

Moreover, the revised overseas investment regime of India provides a notable shift in regulatory clarity, particularly with the refined definition of ‘bona fide business activity’ and explicit permissions for Indian entities investing in foreign entities with subsidiaries in India. While offering a more accommodating regulatory stance, the regime also imposes limitations on the number of subsidiary layers, signalling a cautious approach.

As global entrepreneurship evolves, this comprehensive understanding of regulatory dynamics becomes crucial for startups and investors, emphasizing the need for a balanced regulatory environment that fosters growth and global expansion for Indian startups.